Swing trading is among the most used trading strategies by stock market investors of different levels and experiences. It is perfectly suitable for people working/studying full time or have to do other things during the day.

Usually, the more you work on something, the more you make. However, when it comes to swing trading, it is possible to yield highly profitable results with just 1-2 hrs. of “work” daily.

How? All you have to do is to check the ultimate guide below about the most effective swing trading strategies. This guide is easy to read, and it is primarily meant for novice traders with who are on their early stage in the business.

What is Swing Trading?

Swing trading is a trading technique consisting of buying or selling a stock based on what are called “swings.” These swings are natural oscillations of prices between a high and a low point.

In other words, this method consists of tracking only the most recognizable movements to minimize risks and maximize gains over short periods. Of course, to be truly effective, swing trading must be used in addition to fundamental analysis and knowing investors’ reactions to specific market conditions.

The traders may use the intrinsic or fundamental value of stocks in addition to analyzing the patterns and price trends.

Swing trading consists of looking for specific, predictable price patterns and trying to profit from them.

Since the monitored charts are the ones of multiple days to weeks, the trade takes quite some time to play out, which means that you don’t necessarily need to monitor the trades throughout the whole day.

All you have to do is to analyze the charts, put in orders, set profit and automatic stop-loss orders to limit losses, and you are free to go and enjoy your life.

Now we move on to the step-by-step guide to the swing trading strategies

1st Step

Looking for Profitable Patterns

Profitable patterns are price patterns of stocks/commodities/currencies that occur frequently and therefore are predictable. They allow the trader to forecast what these patterns are likely to do in the future and how to profit from them.

Here is a list of the best swing trading patterns:

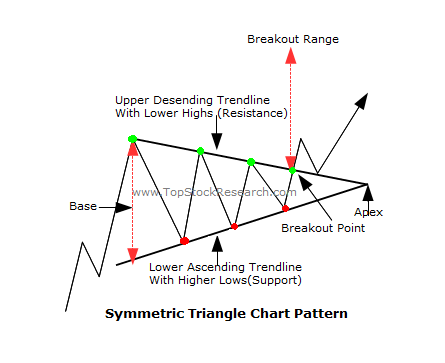

1. Triangle

Triangle shape is one of the best working patterns in terms of success chances. It comes in the three varieties: ascending, descending, and symmetrical. They all share the common notion that the range of a price (high-low) of individual price bars is larger at the pattern’s left side (the base) and that the price range gradually becomes smaller through the time. The apex, which is the pattern’s right side, is where the lowest price ranges are.

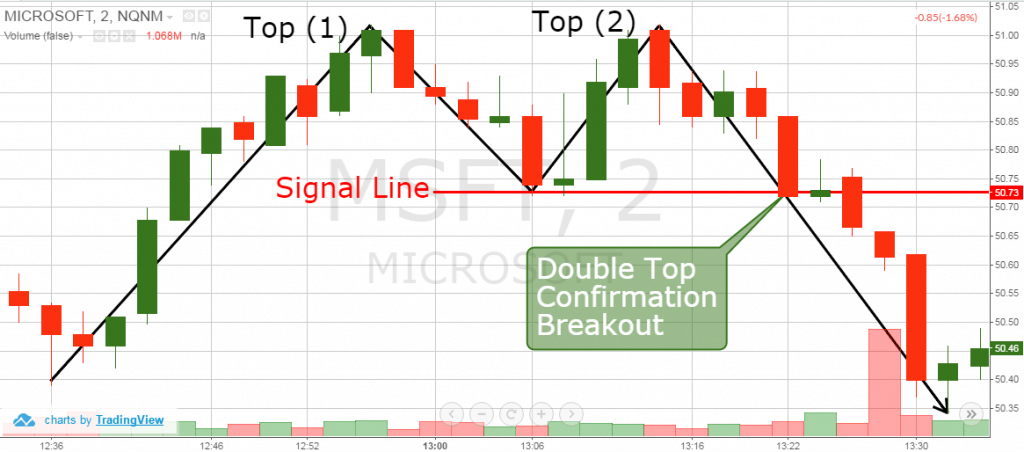

2. Double Top

The double top pattern looks like the letter “M.” It is formed when a new high is created (which called the peak) followed by a retracement downward. The middle section of the “M” is called the through.

3. Channel Pattern

A channel is two parallel resistance and support lines that contain prices. These parallel lines either slope downward or upward. Besides, there should be two valleys creating the support line and two peaks creating the resistance line.

Even though the channel pattern has a less success chance than the other patterns, it can generate high profits when it is appropriately used.

There are two primary ways to trade this pattern: within the channel and breakouts.

Where to Find These Profitable Patterns

a. Stocks

Finviz.com is one of the best stock screeners, and you can use it to find these patterns in stock charts.

First, you need to log into the site and click on “Screener.” Then, filter the results by Volume and price. It is preferable to follow these two main filters: Set the price above $1 to eliminate super volatile penny stocks and set the volume to over 200k to hide the unchangeable stocks. Once you are done with filtering the results, look for your favorite patterns. To do that, click on “Technical,” a list of the different patterns will pop-up, and you can choose the best ones for you. Finally, check throughout the symbols to find great plays.

b. Forex

As for Forex trading, there are only a few dozen instruments to go through instead of exploring hundreds of various patterns. If your Forex broker provides different other tools such as commodities, you should check these out for patterns too.

With fewer instruments, there are fewer opportunities to be found. That is why it is recommended to learn other additional Forex patterns to expand your trading opportunities.

To have a better understanding of the diverse technical trading patterns, you can check Finvids in which you will find a variety of patterns with simplified descriptions.

2nd Step

Grading the Patterns

Now that you are aware of the different profitable chart patterns on the market, let’s move on to the next step: grading the patterns.

It may seem an easy task, but it is not. Besides, if it were that easy, there would be tons of profitable traders.

Sometimes, you may realize that the charts are rather messy when looking for patterns.

Moreover, it is undoubtedly hard to find perfect setups. Thus, it is difficult and frustrating to decide when to participate in specific patterns and when not. But still, there is always a solution to every problem. It is recommended to use an easy, yet efficient grading system.

It is simple to use: you rate a pattern on a scale of 10 based on how pure and clear it is. If it is easy to read and very clear, you rate it with a higher score. When it is messy and hard to read, you rate it with a lower score.

Every time you find a chart and grade it, take a screenshot and save it to an Excel file or a folder. It is an essential step. Your grading ability progresses and gets better by time and experience.

Once you are done with the grading and the different patterns are correctly sorted, you should only take trades on patterns that are rated 6 or above. You don’t need to choose any messy patterns because they will make the trading process worse and stop you out before you reach your profit target.

After all, the best patterns with the highest rates and probability are the right ones to generate high profits.

3rd Step

Managing Bankroll and Growing Your Trading Account Exponentially

Generating high profit, thousands and millions of dollars, is possible, and it is not an overnight process. To yield amazing results, you need to mind the risks too; there is a probability that you might lose your full investment while trading. However, that doesn’t mean that you shouldn’t get into the adventure of stock trading. Dedication, persistence, and with the right knowledge and tools between your hands you will certainly generate high profits.

Don’t get frustrated about the money growth rate, especially at the beginning. It is a slow process and can take months or years to turn little money into a fortune.

You need to set a particular risk level for every trade to achieve constant exponential growth of your money. It is a percentage of the maximum amount of money you are willing to risk in each trade.

1. Minimizing the Risk

It is recommended to have a maximum of 2-3% risk level per each trade to create proper management for your trading portfolio. It highly depends on the size of your account as well.

Besides, the percentage system is dedicated to helping you protect your money. For instance, if you use a 3% stop-loss and you lose, the size of your account is decreased, but your level of risk is reduced as well every time it happens.

If you start with $1000 and lose $500, which is 50% of your account size, the stop-loss would be $50 at first then the risk level would be $25. Even though you are losing some money, the system makes sure that you don’t lose all of it.

Alternatively, you should always keep in mind that when you are starting the trading business with a smaller amount of money, and you want to generate a decent amount of money, you need to increase your risk level. It means that you are risking a high portion of your balance per trade. That is why stock trading looks frustrating, especially in the beginning.

2. Growing Your Account Exponentially

All the successful traders have something in common: making steady gains while efficiently managing their risk level with the right system. Following the same steps of the professionals, you will undoubtedly generate high profits. The percentage risk system helps protect your money and win more as your account grows. Even if you are losing some money, your money will still be safe as the amount you are risking decreases.

3. Profitability and Risk Reward Ratio

Profitability is the percentage of profitable trades. For example, if you win 70 out of 100 trades, your ratio is 70%.

Alternatively, the risk-reward ratio equals the amount you are risking on the amount you are looking to gain. If you are at your early stage in stock trading, it is advised to use a 1-1 risk reward ratio. Which means, if you are risking 3%, you are looking to make 3% as well.

You can start with 1-1 risk reward ratio, and you can adjust as you progress and start to earn more money.

Professional traders have a risk-reward ratio above 1 and profitability ratio above 50%, which means that they are looking to gain more money than they are risking. It is all about finding the perfect strategy. To achieve amazing results, you need to have a high-risk tolerance and always be ready to try different methods and systems until you find the right one for you. You should always learn from your mistakes as well.

To keep track of your trading performance, you have to make statistics and track your trades to look for what is functional and profitable and what is not.

Make sure to follow the instructions and recommendations listed above in order to improve your trading skills and become a better trader. After all, the key to winning in the trading business is proper risk control.

4th Step

Analyzing the Results

Grading is all about analyzing which patterns work best for you and finding where your losses and profits come from.

After rearranging all the graded patterns in an Excel file or in a folder (this instruction was mentioned earlier) and their results, you can analyze each one of them and pick the right ones for you. You are only looking for the highest ranked patterns which will undoubtedly help you with generating high profits.

Also, it is recommended to have at least five examples for every pattern and grade to have a realistic base to make your statistics on.

Analyzing the Profitability

Now that you are done with analyzing the pattern results, you should move on to analyzing the profitability per chart pattern.

Before starting with analyzing each trade, make sure to take a screenshot of the chart pattern and your targets (profit and loss). When the trade is finished, look at the closed positions to check how it went and write down the results to your Excel file. Keeping everything well-organized is beneficial and will certainly make your analysis much clearer.

The Final Content of the Analysis page

- Was the trade profitable?

- What was the used pattern? Double Top/Triangle/Channel/Break Out

- What is the rating of the pattern? Scale of 10

- How much money did I risk? In percentage

- How much money was I aiming to earn? In percentage

This simple technique will help you with identifying the right patterns that actually work the best and eventually help you with improving your profit.

Also, check the average ratio of profitability per pattern (profitable trades/all trades) and average profit compared to the average loss to have a better idea about the average risk-reward ratio. Then, you can adjust depending on these results.

Closing Thoughts

Swing trading can be very rewarding and profitable. Besides, it is a compelling way to practice trading with a few hours per day.

You already have everything you need to know about swing trading in this guide. All you have to do now is to start practicing!